Latest Covid Guidance

Update 5th Jan 2022

As from Tuesday 11 January in England – the following testing change comes into play.

Under the new guidance, anyone in England who receives a positive lateral flow device (LFD) test result should report their result on gov.uk and must self-isolate immediately, but will not need to take a follow-up PCR test.

There are some exemptions to the new rule. People who receive Test and Trace financial support, those taking part in Covid research studies and around one million people in England eligible for new NHS treatments for Covid will all be asked to take a follow-up PCR.

[https://www.bbc.co.uk/news/uk-59878823]

Update 16 December 2021:

What Plan B changes mean generally for businesses and licensed premises ![]()

For Licensed Premises: https://shropshire.gov.uk/…/what-plan-b-means-for…/

For most businesses. https://shropshire.gov.uk/…/new-covid-rules-for…/

*Our thanks to Shropshire Council Public Protection Officers for the update.

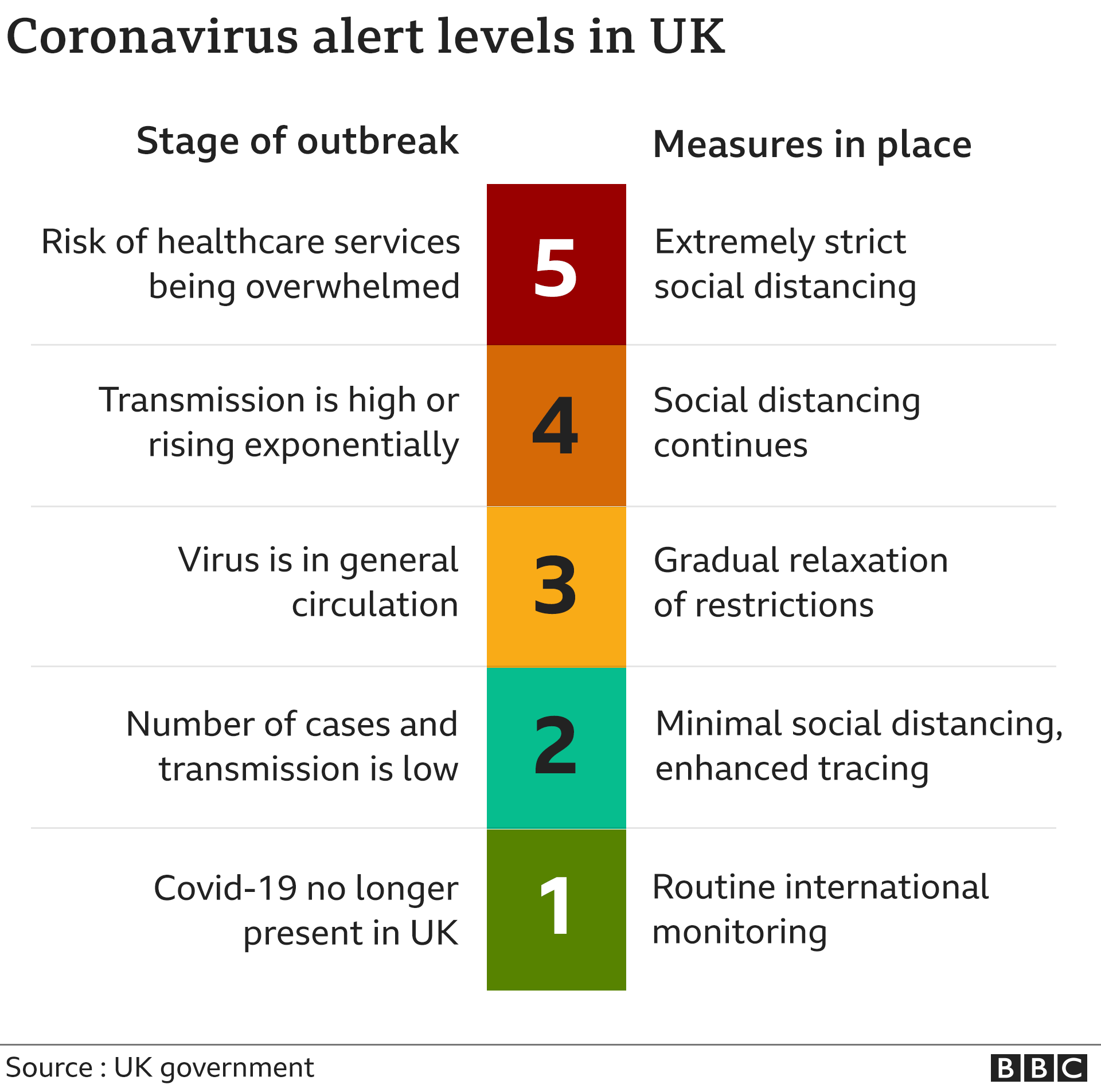

On 12th December 2021, the UK’s coronavirus alert level has been raised to level four due to the spread of Omicron.

Moving to Plan B, this guidance applies to England:

- You must wear a face covering in most indoor public places, at large venues and events, and on public transport.

- From 13 December, you should work from home if you can.

- From 15 December you’ll need to show your NHS COVID Pass at nightclubs, some venues and large events to show you’re fully vaccinated, have had a negative test result in the last 48 hours, or you have an exemption.

As from Tuesday, 30 November 2021, the UK Government brought in new guidance in response to the Omicron variant of SARS-CoV-2 (Covid).

As from Tuesday, 30 November 2021, the UK Government brought in new guidance in response to the Omicron variant of SARS-CoV-2 (Covid).

Source: https://www.gov.uk/coronavirus

Summary:

You must wear a face covering in shops and on public transport. Face coverings should be worn in communal areas of universities, colleges and schools by staff, visitors and pupils or students in year 7 and above.

Face coverings are not legally required in hospitality settings given that they cannot be worn while eating and drinking

From 30 November 2021, there are some places where you must wear a face covering by law, unless you are exempt or have a reasonable excuse (see the ‘When you do not need to wear a face covering’ section below).

In England, you must wear a face covering in the following indoor settings (examples are given in brackets):

- shops and supermarkets (places which offer goods or services for retail sale or hire)

- shopping centres (malls and indoor markets)

- auction houses

- post offices, banks, building societies, high street solicitors and accountants, credit unions, short-term loan providers, savings clubs and money service businesses

- estate and letting agents

- premises providing personal care and beauty treatments (barbers, hair salons, tattoo and piercing studios, nail salons and massage centres)

- pharmacies

- premises providing veterinary services

- retail galleries

- retail travel agents

- takeaways without space for consumption of food or drink on premises

- public transport (aeroplanes, trains, trams, buses, coaches and ferries), taxis and private hire vehicles

- any car or small van during a professionally delivered driving lesson, a practical driving test, or during one of the practical tests for giving driving instruction, and in all HGV lessons and tests

- transport hubs (airports, rail and tram stations and terminals, maritime ports and terminals, bus and coach stations and terminals)

Key Covid Update pages

- Local businesses and organisations that provide PPE, Social Distancing materials, Hygiene supplies such as hand sanitiser, and other key products.https://www.oneoswestry.co.uk/covid-19/ppe-social-distancing-and-hygiene-supplies-for-covid-19/

- Coronavirus Business Info on Funds & Grantshttps://www.oneoswestry.co.uk/covid-19/covid-19-business-information/

- Shropshire Council have produced a new toolkit for businesses offering advice about reopening as lockdown measures are eased.https://www.oneoswestry.co.uk/shropshire-council-reopening-your-business-in-shropshire-toolkit/

- General crime prevention tips that may assist your organisation in this time.https://www.oneoswestry.co.uk/covid-19-crime-prevention-information/

- Action Fraud – the National Fraud and Cyber Crime reporting centre have seen and increased in relation to Coronvirus related scams.https://www.oneoswestry.co.uk/covid-19-cyber-security-fraud-and-scams/

- The NHS test and trace service forms a central part of the government’s coronavirus (COVID-19) recovery strategy, which seeks to help the nation return to normal as soon as possible for as many people as possible, in a way that is safe and protects the NHS and social care sector.https://www.oneoswestry.co.uk/covid-19-nhs-test-and-trace-in-the-workplace-guidance/

- Welcome to One Oswestry’s Health & Well-Being page.https://www.oneoswestry.co.uk/covid-19/health-well-being-resources/

Main UK Gov help pages:

COVID-19 Business Support

Financial support for businesses during coronavirus (COVID-19)

Marches Growth Hub COVID-19 Support Page

Updated 24 September 2020

IMPORTANT NEW COVID REGULATIONS have come into play today, stating that for venues in hospitality, the tourism and leisure industry, close contact services and local authority facilities…you must do the following.

This includes registering for your NHS QR Code Poster for Track & Trace.

Updated 18 June 2020 at 11.04pm

Coronavirus (COVID-19): getting tested

Updated 28th May 2020 at 12.53pm

Shropshire Council has today launched its £4.5million ‘Top Up’ grant scheme

Shropshire Council has today launched its £4.5million ‘Top Up’ grant scheme in support of businesses who have been unable to access COVID-19 related business grants to date. The grants are now live and are targeting those businesses who weren’t eligible for the small business and retail, leisure and hospitality grants.

The Government has prioritised the following sectors, so the first round of this competitive funding round is now open exclusively for these businesses and will close at 23.59pm on Sunday 7 June 2020.

- Small businesses in shared offices or flexible workspaces(such as units in industrial parks and incubators) which do not have their own business rates assessment. Grant funding available of 2,500 per business in office accommodation (B1), up to 10,000 if located in industrial / warehouse facility (B2 & B8).

- Regular market traderswith fixed building costs, such as rent, who do not have their own business rates assessment. Grant funding of 2,500 per trader.

- Bed & Breakfastswhich pay Council Tax instead of business rates. Grant funding of 2,500 available for businesses operating premises with less than 6 beds, which is the expected number to pay Council Tax.

- Charities that are based in commercial propertiesin receipt of charitable business rates relief which has not been eligible for the Retail, Hospitality and Leisure grant can apply for 5,000 grant funding.

Businesses are encouraged to apply as soon as possible, as we will have to manage the limited funds on a first come first served basis.

Updated 26th May 2020 at 9.43am

Coronavirus sick pay scheme opens for applications

Small businesses and employers across the UK who have paid statutory sick pay to staff taking coronavirus-related leave will be able to claim back the money from today.

The scheme allows small and medium sized employers, with fewer than 250 members of staff, to apply to recover the costs of paying coronavirus-related Statutory Sick Pay for two weeks – worth nearly £200 per employee.

Launching on gov.uk today, the new online service is being run by HMRC, and after making an application employers will receive the money within six working days.

To get the rebate, employers will need to go online and input simple information on the employees being claimed for.

The service can be accessed here.

Updated 20th May 2020 at 6.30pm

Future Fund launches today

The government’s £500 million Future Fund opens for applications today (Wednesday 20 May) with innovative and high-growth British businesses able to secure investment to help them through the Coronavirus outbreak.

UK-based companies can now apply for a convertible loan of between £125,000 and £5 million, to support continued growth and innovation in sectors as diverse as technology, life sciences and the creative industries.

The government has made an initial £250 million available for investment through the scheme and will consider increasing this if needed.

Private investors – potentially including venture capital funds, angel investors and those backed by regional funds – will at least match the government investment in these companies.

The Fund will be open until September and is delivered in partnership with the British Business Bank.

Notes

- The Future Fund is open to UK-based firms, that have previously raised at least £250,000 in equity investment from third parties in the last 5 years. They will also need to have investors to provide funding to be matched by the government, and have half or more of their employees based in the UK or generate at least half of their revenue through UK sales. The loans will convert to equity if not repaid.

- Companies can check they meet the criteria for funding by going to the British Business Bank website. If they have secured private match funding, one of their investors can register online to start the application process.

Updated 20th May 2020 at 10.30am

Covid Corporate Financing Facility

Under the COVID-19 Corporate Financing Facility (CCFF), the Bank of England will buy short-term debt from large companies.

This scheme will support your company if it’s been affected by a short-term funding squeeze, and allow you to finance your short-term liabilities.

It will also support corporate finance markets overall and ease the supply of credit to all firms.

The scheme is delivered through commercial lenders, backed by the Bank of England.

It will operate for at least 12 months, and for as long as steps are needed to relieve cash flow pressures on firms that make a material contribution to the UK economy.

Updated 19th May 2020 at 5.30pm

Larger businesses to benefit from loans of up to £200 million

Government extends maximum loan size available through the Coronavirus Large Business Interruption Loan Scheme from £50 million to £200 million.

- loans under the expanded scheme will be made available to large businesses affected by coronavirus from next week

- changes also mean companies receiving help through CLBILS and the Bank of England’s Coronavirus Corporate Financing Fund will be asked to agree to not pay dividends and to exercise restraint on senior pay

The maximum loan size available under the scheme will be increased from £50 million to £200 million to help ensure those large firms which do not qualify for the Bank of England’s Covid Corporate Financing Facility (CCFF) have enough finance to meet cashflow needs during the outbreak.

Further Information

- borrowers under CLBILS will be able to borrow up to 25% of turnover, up to a maximum of £200 million

- lenders who wish to offer larger loans will need to undergo further accreditation checks

The restrictions in place will include:

- Dividends: Borrowers cannot make any dividend payments other than those that have already been declared

- Share buyback: Borrowers agree not to make any share buybacks

- Executive pay: Borrowers cannot pay any cash bonuses, or award any pay rises to senior management (including the board) except where they were a) declared before the CLBILS loan was taken out, b) is in keeping with similar payments made in the preceding 12 months, and c) does not have a material negative impact on the borrower’s ability to repay the loan.

Updated 13th May 2020 at 1pm

Which businesses and venues are to stay closed, and which are the exceptions?

Here is the latest government guidance as to which businesses and venues are to stay closed for now, which are the exceptions, and how they must go about it.

“All businesses and venues outlined in the table below must not open to the public: failure to follow the law relating to these closures can lead to the individual responsible for the business being issued a prohibition notice, a fixed penalty notice or prosecution.

Takeaway and delivery services may remain open and operational in line with guidance below. Online retail and click and collect services may continue.”

Updated 13th May 2020 at 12.30pm

‘Our Plan to Rebuild’ – the UK Government’s COVID-19 Recovery Strategy

Some key aspects of the advice:

- Opening non-essential retail when and where it is safe to do so, and subject to those retailers being able to follow the new COVID-19 Secure guidelines. The intention is for this to happen in phases from 1 June; the Government will issue further guidance shortly on the approach that will be taken to phasing, including which businesses will be covered in each phase and the timeframes involved. All other sectors that are currently closed, including hospitality and personal care, are not able to re-open at this point because the risk of transmission in these environments is higher. The opening of such sectors is likely to take place in phases during step three, as set out below.

- The next step will also take place when the assessment of risk warrants further adjustments to the remaining measures. The Government’s current planning assumption is that this step will be no earlier than 4 July, subject to the five tests justifying some or all of the measures below, and further detailed scientific advice, provided closer to the time, on how far we can go. The ambition at this step is to open at least some of the remaining businesses and premises that have been required to close, including personal care (such as hairdressers and beauty salons) hospitality (such as food service providers, pubs and accommodation), public places (such as places of worship) and leisure facilities (like cinemas). They should also meet the COVID-19 Secure guidelines. Some venues which are, by design, crowded and where it may prove difficult to enact distancing may still not be able to re-open safely at this point, or may be able to open safely only in part. Nevertheless the Government will wish to open as many businesses and public places as the data and information at the time allows.

- In order to facilitate the fastest possible re-opening of these types of higher-risk businesses and public places, the Government will carefully phase and pilot re-openings to test their ability to adopt the new COVID-19 Secure guidelines. The Government will also monitor carefully the effects of reopening other similar establishments elsewhere in the world, as this happens. The Government will establish a series of taskforces to work closely with stakeholders in these sectors to develop ways in which they can make these businesses and public places COVID-19 Secure

Download the full report here.

Updated 5th May 2020 at 1.30pm

Top-up to local business grant funds scheme

This additional fund is aimed at small businesses with ongoing fixed property-related costs. We are asking local authorities to prioritise businesses in shared spaces, regular market traders, small charity properties that would meet the criteria for Small Business Rates Relief, and bed and breakfasts that pay council tax rather than business rates. But local authorities may choose to make payments to other businesses based on local economic need. The allocation of funding will be at the discretion of local authorities.

Businesses must be small, under 50 employees, and they must also be able to demonstrate that they have seen a significant drop of income due to Coronavirus restriction measures.

There will be three levels of grant payments. The maximum will be £25,000. There will also be grants of £10,000. local authorities will have discretion to make payments of any amount under £10,000. It will be for councils to adapt this approach to local circumstances.

Further guidance for local authorities will be set out shortly.

READ MORE: https://www.gov.uk/government/news/top-up-to-local-business-grant-funds-scheme

Updated 4th May 2020 at 1.30pm

Bounce Back Loan (BBL) Scheme opens for applications

For latest info, visit: https://www.oneoswestry.co.uk/news/bounce-back-loan-bbl-scheme-now-available/

Updated 28th April 2020 at 11.15am

Small businesses boosted by bounce back loans – New 100% government backed loan scheme for small business

- businesses will be able to borrow between £2,000 and £50,000 and access the cash within days

- loans will be interest free for the first 12 months, and businesses can apply online through a short and simple form

Small businesses will benefit from a new fast-track finance scheme providing loans with a 100% government-backed guarantee for lenders, the Chancellor announced today (Monday 27 April).

Rishi Sunak said the new Bounce Back Loans scheme, which will provide loans of up to £50,000, would help bolster the existing package of support available to the smallest businesses affected by the coronavirus pandemic.

The scheme has been designed to ensure that small firms who need vital cash injections to keep operating can get finance in a matter of days, and comes alongside the £6 billion awarded in business grants, supporting 4 million jobs through the job retention scheme and generous tax deferrals supporting hundreds of thousands of firms.

The government, which has been consulting extensively with business representatives about the design of the new scheme, will provide lenders with a 100% guarantee for the loan and pay any fees and interest for the first 12 months. No repayments will be due during the first 12 months.

The loans will be easy to apply for through a short, standardised online application. The loan should reach businesses within days- providing immediate support to those that need it as easily as possible.

Updated 24th April 2020 at 3pm

New measures to protect UK high street from aggressive rent collection and closure

- Government to introduce temporary new measures to safeguard the UK high street against aggressive debt recovery actions during the coronavirus pandemic

- statutory demands and winding up petitions issued to commercial tenants to be temporarily voided and changes to be made to the use of Commercial Rent Arrears Recovery, building on measures already introduced in the Coronavirus Act

- landlords and investors asked to work collaboratively with high street businesses unable to pay their bills during COVID-19pandemic

High street shops and other companies under strain will be protected from aggressive rent collection and asked to pay what they can during the coronavirus pandemic, the Business Secretary has set out today (23 April 2020).

Updated 20th April 2020 at 1pm

Coronavirus Job Retention Scheme up and running

The Government’s Coronavirus Job Retention Scheme went live today, with businesses able to claim up to £2,500 a month towards staff wages.

- Government’s furlough scheme opens for applications today – 10 days ahead of schedule

- employers can now go online to claim cash grants worth up to 80% of wages, capped at £2,500 a month per worker

- 5000 HMRC staff will operate the scheme – which is expected to help thousands of firms across the UK

Who can claim

You must have:

- created and started a PAYE payroll scheme on or before 19 March 2020

- enrolled for PAYE online

- a UK bank account

Any entity with a UK payroll can apply, including businesses, charities, recruitment agencies and public authorities.

KEY INFO: https://www.gov.uk/government/news/coronavirus-job-retention-scheme-up-and-running

Updated 18th April 2020 at 5pm

Councils across England will receive another £1.6 billion in additional funding as they continue to respond to the coronavirus pandemic.

Summary:

- Councils across England will receive a further £1.6 billion to help them to deal with the immediate impacts of coronavirus

- This takes the total funding to support councils to respond to the pandemic to over £3.2 billion

- Over 5,400 vulnerable rough sleepers helped off the streets and from communal shelters during pandemic

- Local Government Secretary has written to all councils praising the ‘unsung heroes’

- This will mean an extra £300 million for the devolved administrations, £155 million for Scotland, £95 million for Wales and £50 million for Northern Ireland

MORE: https://www.gov.uk/government/news/government-pledges-extra-16-billion-for-councils

Updated 18th April 2020 at 2pm

Coronavirus Job Retention Scheme: step by step guide for employers

This guide explains the information that employers need to provide to claim for their employees’ wages.

Updated 16th April 2020 at 4pm

Coronavirus: Emergency grants to support county’s arts sector

“In response to the current crisis, Shropshire Council is providing emergency grant funding for arts organisations, venues and festivals in the county.

The aim of the funding is to support arts organisations over the next six months, to develop and deliver digital and online programmes of work, and to continue to engage with user groups, communities, participants and audiences in a virtual way.

The funding will help ensure all sections of the community still have opportunities to experience high quality arts activity.

This funding is in addition to the Arts Grants funding which was launched in March 2020. Eligible organisations will be able to apply for both pots of funding.

Professional arts organisations, festivals and venues are invited to apply for one grant of £1,000.

This funding is intended to provide financial support for professional arts organisations / festivals whose programmes have been impacted by coronavirus.

Specifically, it is for those who regularly deliver high quality programmes of work directly benefitting artists, participants, audiences, and those who contribute to Shropshire Council’s priorities, whose programmes have been impacted by coronavirus.”

MORE INFO: https://newsroom.shropshire.gov.uk/2020/04/emergency-grants-arts/

Councils will be allowed to defer £2.6 billion in business rates payments to central government, and £850 million in social care grants will be paid up front this month.

“New measures to help ease immediate financial pressures faced by councils in England due to the coronavirus outbreak have been announced by the government today (16 April 2020).

Councils will be allowed to defer £2.6 billion in business rates payments to central government, and £850 million in social care grants will be paid up front this month in a move aimed at helping to ease immediate pressures on local authority cash flows.”

Updated 2nd April 2020 at 10.20am

Covid-19 business grant schemes for Small Businesses, Retail, Hospitality and Leisure

In response to the Coronavirus pandemic, the Government have announced support for small business, and businesses in the retail, hospitality and leisure sectors. This support will take the form of two grant funding schemes, the Small Business Grant Fund, and the Retail, Hospitality and Leisure Grant Fund. Only one grant will be awarded per hereditament.

Businesses which are not ratepayers in the business rates system are not included in this scheme.

Please note, if you are occupying the premises, but are not the ratepayer as addressed, please advise the business rates team at: business.rates@shropshire.gov.uk

Details of both schemes can be accessed from the Gov.UK website by following this link

Further information

Small Business Grant

Under the Small Business Grant Fund, all businesses in England in receipt of either Small Business Rate Relief or Rural Rate Relief in the business rates system will be eligible for a payment of £10,000, providing they meet the eligibility rules given here.

To be included a business must be eligible for either relief as at 11 March 2020 and have a rateable value of £15,000 or less.

Some businesses are excluded from this scheme. They are:

- Businesses occupied for personal uses, such as private stables and loose boxes, or moorings

- Car parks and parking spaces

- Businesses that as of 11 March were in liquidation, or were dissolved are not eligible

The person who the billing authority have identified as the ratepayer in respect of the business premises on that day will be eligible for the grant.

Retail, Hospitality and Leisure Grant

Under the Retail, Hospitality and Leisure Grant eligible businesses in England in receipt of the Expanded Retail Discount (which covers retail, hospitality and leisure) with a rateable value of less than £51,000 will be eligible for cash grants of £10,000 or £25,000 per property.

Eligible businesses in these sectors with a property that has a rateable value of up to and including £15,000 will receive a grant of £10,000.

Eligible businesses in these sectors with a property that has a rateable value of over £15,000 and less than £51,000 will receive a grant of £25,000.

Some businesses are excluded from this scheme. They are:

- Recipients eligible for the Small Business Grant Fund will not be eligible for the Retail, Hospitality and Leisure Grant

- Businesses occupied for personal uses, such as private stables and loose boxes, or moorings

- Car parks and parking spaces

- Businesses that as of 11 March 2020 were in liquidation, or were dissolved are not eligible

- Hereditaments with a rateable value of £51,000 or over

The person who the billing authority have identified as the ratepayer in respect of the business premises on that day will be eligible for the grant.

Post Grant Award Assurance

The Government have advised that any business caught falsifying their records to gain additional grant money will face prosecution and any funding issued will be subject to clawback. The Government expect Local Authorities to be making checks to provide grant payment assurances and the Government will support Local Authorities in carrying out post-event assurances.

State Aid

Although the United Kingdom left the EU on 31 January 2020, as part of the withdrawal agreement State Aid rules continue to apply during the transition period. For further information on state aid law please visit https://www.gov.uk/state-aid

If you have been offered Small Business Grant Fund as de minimus aid you can only receive up to 200,000 euros over a three-year period. If you have been offered Small Business Grant Fund you can only receive up to 800,000 euros under the Temporary Framework (other conditions apply).

Apply here – https://shropshire.gov.uk/covid-19-grants

Updated 1st April 2020 at 6.15pm

Small Business Grant Fund/Retail, Hospitality and Leisure Grant Fund: guidance for businesses

This guidance sets out details and eligibility criteria for:

– the Small Business Grants Fund (SBGF)

– the Retail, Hospitality and Leisure Grant Fund (RHLGF)

It informs businesses about the operation and delivery of the 2 funding schemes.

The guidance applies to England only.

Updated 1st April 2020 at 12.02pm

Coronavirus Job Retention Scheme

What is it?

Under the Coronavirus Job Retention Scheme, all UK employers with a PAYE scheme that was created and started on or before 28 February 2020, will be able to access support to continue paying part of their employees’ salary for those that would otherwise have been laid off during this crisis. This applies to employees who have been asked to stop working, but who are being kept on the pay roll, otherwise described as ‘furloughed workers’. HMRC will pay employers a grant worth 80% of an employee’s usual wage costs, up to £2,500 a month, plus the associated Employer National Insurance contributions and minimum automatic enrolment employer pension contributions on that subsidised wage. This is to safeguard workers from being made redundant. The Coronavirus Job Retention Scheme will cover the cost of wages backdated to March 1st if applicable and is initially open for 3 months, but will be extended if necessary.

Am I eligible?

All UK-wide employers with a PAYE scheme that was created and started on or before 28 February 2020 will be eligible including:

- Businesses,

- Charities,

- Recruitment Agencies (agency workers paid through PAYE),

- Public Authorities

The employer must have a UK bank account.

How do I access it?

You will need to:

- Designate affected employees as ‘furloughed workers,’ and notify your employees of this change – changing the status of employees remains subject to existing employment law and, depending on the employment contract, may be subject to negotiation.

- Once the new online portal is live, submit information to HMRC about the employees that have been furloughed and their earnings.

When can I access it?

HMRC are working urgently to set up a system to pay these grants. We expect the first grants to be paid within weeks, and we’re aiming to get it done before the end of April. If your business needs short term cash flow support, you may be eligible for a Coronavirus Business Interruption Loan.

Further guidance

For more information on the Coronavirus Job Retention Scheme please read the guidance for employers. We have also published guidance for employees.

More information is available here – https://www.businesssupport.gov.uk/coronavirus-job-retention-scheme/

HMRC Webinar – Coronavirus (COVID-19) – helping employers to support employees

HMRC are running several webinars over the next few days, providing an overview of the support available to help employers and their staff in addressing Coronavirus (COVID-19) – including the Coronavirus Job Retention Scheme, refunding eligible Statutory Sick Pay costs, furloughed employees and more.

Sign up here: socsi.in/Kjwxo

Updated 28th March 5pm

Free parking in Shropshire Council car parks from today (28/3/2020)

In Oswestry, these car parks include OAK STREET, FESTIVAL SQUARE, OSWALD ROAD, GATACRE & LLOYD STREET.

(More: https://www.shropshire.gov.uk/parking/find-my-nearest-car-park/)

Shropshire Council said, “As a result of the coronavirus pandemic Shropshire Council is to provide free parking in all of its car parks from Saturday 28 March 2020 until further notice.”

Steve Davenport, Shropshire Council’s Cabinet member for highways and transport, said:

“As well as providing free parking for our fantastic NHS staff, volunteers, social care staff and other key workers, I’m pleased that we can go further and make our car parks free for all users, to help those who need to make essential trips to buy food and medicine.

“We do appeal to everyone that whilst using our car parks please adhere to the Government and Public Health England’s advice relating to coronavirus prevention measures, particularly self-distancing.”

On-street parking charges will remain so that the parking bays can be used for those needing to use the 15 minutes’ ‘pop and shop’ free parking and to provide short-stay and easy access to essential services in the town centres – especially for those who find it difficult to walk significant distances.

People holding a current residents’ permit or season ticket are advised that Shropshire Council will review these at a time when face-to-face contact is permitted and these will remain valid until further notice. If the permit expires they don’t need to purchase another permit until further notice – and people holding paper permit should continue to display them in their vehicle.

[Source: https://newsroom.shropshire.gov.uk/2020/03/free-parking-in-shropshire-council-car-parks-for-nhs-staff-nhs-volunteers-and-care-workers/]

Updated 27th March 4pm

Park and ride buses to provide free transport for hospital staff

SUMMARY

Shropshire Council is to deploy its park and ride buses and drivers to provide free transport between Shrewsbury and Telford hospitals for hospital staff, in particular a number of student nurses that need to travel between Telford and Shrewsbury each day for training

Following a fall in passenger numbers the Shrewsbury park and ride service will be suspended after the last journey this Saturday (28 March) until further notice.

FULL ARTICLE: https://newsroom.shropshire.gov.uk/2020/03/park-and-ride-buses-to-provide-free-transport-for-hospital-staff/

Updated 26th March 5pm

Shropshire Council pledges £295,000 for voluntary and community groups responding to the impact of coronavirus

From Shropshire Council

Shropshire Council is providing a package of financial support to community groups and voluntary organisations who are providing critical support to those impacted by coronavirus (COVID-19) living here.

Shropshire is fortunate to have communities that want to come together to support themselves at times like this, with local councils and councillors often playing an important role in leading and co-ordinating activity. We also have a host of voluntary and community organisations that work tirelessly with their volunteers to provide vital services to older people and vulnerable people across the county.

To support this work at a time when the need for their support has never been so important, Shropshire Council will fund local community and voluntary organisation activity in the following ways –

- £75,000 for local community groups, including community centres and village halls – to be made available in grants up to a maximum of £500.

- £100,000 for groups and initiatives providing food and home supplies to older people and vulnerable residents.

- £120,000 investment in our key voluntary organisations, to enable them to both deliver vital support, and provide support to our communities to do this.

Read more… https://newsroom.shropshire.gov.uk/2020/03/coronavirus-community-funding/

Updated 25th March 2pm

The Coronavirus Business Interruption Loan Scheme (CBILS) is now available through participating lenders

CBILS is a new scheme, announced by The Chancellor at Budget 2020, that can provide facilities of up to £5m for smaller businesses across the UK who are experiencing lost or deferred revenues, leading to disruptions to their cashflow.

CBILS supports a wide range of business finance products, including term loans, overdrafts, invoice finance and asset finance. The scheme provides the lender with a government-backed guarantee potentially enabling a ‘no’ credit decision from a lender to become a ‘yes’. The borrower always remains 100% liable for the debt.

CBILS: KEY FEATURES

- Up to £5m facility: The maximum value of a facility provided under the scheme will be £5m, available on repayment terms of up to six years.

- 80% guarantee: The scheme provides the lender with a government-backed, partial guarantee (80%) against the outstanding facility balance, subject to an overall cap per lender.

- No guarantee fee for SMEs to access the scheme: No fee for smaller businesses. Lenders will pay a fee to access the scheme.

- Interest and fees paid by Government for 12 months: The Government will make a Business Interruption Payment to cover the first 12 months of interest payments and any lender-levied fees[1], so smaller businesses will benefit from no upfront costs and lower initial repayments.[2]

- Finance terms: Finance terms are up to six years for term loans and asset finance facilities. For overdrafts and invoice finance facilities, terms will be up to three years.

- Security: At the discretion of the lender, the scheme may be used for unsecured lending for facilities of £250,000 and under. For facilities above £250,000, the lender must establish a lack or absence of security prior to businesses using CBILS. If the lender can offer finance on normal commercial terms without the need to make use of the scheme, they will do so.

- The borrower always remains 100% liable for the debt.

ELIGIBILITY CRITERIA

Smaller businesses from all sectors[3] can apply for the full amount of the facility. To be eligible for a facility under CBILS, an SME must:

- Be UK-based in its business activity, with annual turnover of no more than £45m

- Have a borrowing proposal which, were it not for the current pandemic, would be considered viable by the lender, and for which the lender believes the provision of finance will enable the business to trade out of any short-to-medium term difficulty.

Please note: If the lender can offer finance on normal commercial terms without the need to make use of the scheme, they will do so.

[1] Following earlier discussions with the banking industry, some lenders indicated that they would not charge arrangement fees or early repayment charges to SMEs borrowing under the scheme. HM Government greatly appreciates this approach by lenders.

[2] Fishery, aquaculture and agriculture businesses may not qualify for the full interest and fee payment.

[3] The following trades and organisations are not eligible to apply: Banks, Building Societies, Insurers and Re-insurers (but not insurance brokers); The public sector including state funded primary and secondary schools; Employer, professional, religious or political membership organisation or trade unions.

Find out how to apply for a CBILS-backed loan facility

Updated 25th March 10.25am

Companies to receive 3-month extension period to file accounts during COVID-19

From today (25 March 2020), businesses will be able to apply for a 3-month extension for filing their accounts.

This joint initiative between the government and Companies House will mean businesses can prioritise managing the impact of Coronavirus.

As part of the agreed measures, while companies will still have to apply for the 3-month extension to be granted, those citing issues around COVID-19 will be automatically and immediately granted an extension. Applications can be made through a fast-tracked online system which will take just 15 minutes to complete.

Visit the government website for more information on how to apply.

Shropshire Council support for residents impacted by the coronavirus pandemic

We’re offering residents whose employment or income has been adversely impacted by the coronavirus pandemic the opportunity to delay payment of council tax until 1 June 2020.

Visit the Shropshire Council website for more information and how to apply.

MOTs for cars, vans and motorcycles due from 30 March 2020

The Government has announced that from 30 March 2020, MOT due dates for cars, motorcycles and light vans will be extended by 6 months. This is being done to help prevent the spread of coronavirus.

Please check the government website for more information.

Updated 24th March 3.30pm

Shropshire Council – Coronavirus: Government support to help protect businesses

The Chancellor has set out a package of temporary, timely and targeted measures to support public services, people and businesses through this Coronavirus emergency. This includes a package of measures to support businesses including the following.

For the latest information about business advice and support please visit the Invest in Shropshire website.

- £330bn of Government-backed and guaranteed loan

- No business rates payable for 12 months, extended to retail, leisure, hospitality and nursery businesses of all sizes

- Cash grants for up to £25,000 for smaller retail, leisure and hospitality businesses with rateable values below £51k, who do not have insurance to cover pandemics

- Cash grants of £10,000 for the 700,000 businesses who do not pay business rates

- A mortgage holiday of three months for people struggling to make mortgage payments as a result of Coronavirus

- Government have also granted permission for pubs and restaurants to operate as takeaways as part of their coronavirus response

- A new Coronavirus Business Interruption Loan Scheme, will enable businesses to apply for a loan of up to £5 million, with the first 12 months interest and fees paid by Government

- A dedicated helpline has been set up to help businesses and self-employed individuals receive support with their tax affairs, where businesses may be able to agree a bespoke Time to Pay arrangement. Call HMRC’s dedicated helpline on 0800 0159 559

- For businesses with fewer than 250 employees, the cost of providing 14 days of Statutory Sick Pay per employee will be refunded by the Government in full

- Coronavirus Job Retention Scheme

- Support for larger firms through the COVID-19 Corporate Financing Facility.

Click here to view further information and eligibility criteria.

Further details on how to access this support will be available in due course.

For any business enquiries related to COVID-19 please contact COVID19businessenquiries@shropshire.gov.uk

For advice and support regarding business rates, including holidays, relief or setting up payment schedules over 12 months, please contact business.rates@shropshire.gov.uk

Other useful links and contact details include:

Coronavirus Business Interruption Loan Scheme

Government Business Support Helpline – Telephone: 0300 456 3565 (Monday to Friday, 9am to 6pm)

[Source: https://newsroom.shropshire.gov.uk/2020/03/coronavirus-support-businesses/]

Updated 23rd March 5pm

Given the increase in broadband usage, BT Updates states…

“At this very busy time, we’re constantly monitoring our broadband network and doing everything we can to continue to support and provide a brilliant service to you and the critical services we enable. We have built in more than 10 times the capacity needed for everyday use, so have more than enough even with the massive increase in working from home that we’re seeing right now.

We can also support the extra calls that people will make to keep in touch with friends, family and colleagues. We’re monitoring our network closely so if data usage does increase, we’ll handle that, too.”

[Source: https://www.bt.com/coronavirus]

Updated 20th March 3.45pm

Shropshire Council – Restrictions on concessionary bus travel lifted due to coronavirus

In response to the coronavirus pandemic, Shropshire Council has extended its concessionary bus travel for the elderly and vulnerable, to enable them to take advantage of the exclusive early morning shopping times being offered by some supermarkets and shops.

Until today concessionary bus passes couldn’t be used before 9.30am.

Under the new arrangement the passes can be used before 9.30am, with immediate effect and until further notice.

The change applies to all bus services operating in the Shropshire Council area.

READ MORE…on concessionary bus travel

Updated 19th March 2.30pm

Shropshire Council: Coronavirus (COVID-19): waste and recycling services

We are working closely with our partner Veolia to minimise the impact of coronavirus on recycling and waste services. Business continuity plans have been successfully implemented and resources are being closely monitored to ensure the most essential services can continue to be delivered safely.

Currently services are operating with no significant disruption.

Please continue to use your recycling and waste collection services as normal, with the following important exception:

Households that are self isolating should follow the UK Government’s ‘Stay at home’ advice which states:

- Store personal waste such as used tissues and disposable cleaning cloths securely within disposable rubbish bags. Please do not place any of these items in your recycling containers as they will not be collected

- Place these bags into another bag, tied securely and keep separate from other waste

- These bags should be put aside for at least 72 hours, before being put in your usual external general waste bin

- Please do not take this waste to your local Household Waste and Recycling Centre.

Please dispose of your other household waste as normal. It is more important than ever to ensure that recycling is clean and dry, and that any rubbish bags are all securely tied, to help prevent spills and protect our collection teams and the public.

[Source: https://newsroom.shropshire.gov.uk/2020/03/coronavirus-waste-recycling/]

Updated 18th March 4.30pm

Shropshire Council is urgently working through a number of measures to support local businesses through the coronavirus pandemic.

Shropshire Council has over 12,000 businesses listed for business rates but of those, over 5,400 don’t pay any business rates currently as they receive 100% small business rate relief. On 17 March 2020 the Government have announced that these businesses will receive an additional 10,000 grant to assist them with ongoing business costs.

Also, it has been announced that retail relief has been increased for 2020-21 to 100% and extended to include leisure and hospitality businesses. Also, qualifying retail, hospitality and leisure businesses with a rateable value of less than 51,000 will receive a 25,000 grant.

We would ask all businesses to bear with us while we wait for further clarification from the Government about how this assistance will work. Please be assured that we are working to get these reductions notified to qualifying businesses as soon as we can.

Any other businesses that won’t qualify for these reliefs but who would like to discuss their payments or spread their instalments over twelve months should contact business.rates@shropshire.gov.uk.

We have also added a page to the Invest in Shropshire website with the latest COVID-19 support, details can be found at http://www.investinshropshire.co.uk/business-support-advice-covid-19/.

Updated 18th March 10.30am

The Chancellor has set out a package of temporary, timely and targeted measures to support public services, people and businesses through this period of disruption caused by COVID-19.

This includes a package of measures to support businesses including:

- a statutory sick pay relief package for SMEs

- a 12-month business rates holiday for all retail, hospitality and leisure businesses in England

- small business grant funding of £10,000 for all business in receipt of small business rate relief or rural rate relief

- grant funding of £25,000 for retail, hospitality and leisure businesses with property with a rateable value between £15,000 and £51,000

- the Coronavirus Business Interruption Loan Scheme to support long-term viable businesses who may need to respond to cash-flow pressures by seeking additional finance

- the HMRC Time To Pay Scheme

[Source: gov.uk]

Updated 17th March 2020 7pm

Following the government announcement at 5pm, among the new support includes:

- Government backed and guaranteed loans of £330bn to support companies

- A potential support package specifically for airlines and airports

- A three-month mortgage payment holiday for homeowners

- £10,000 cash grants for smaller firms

- An extension of the business rate holiday announced in the Budget

[Source: BBC]

Updated 17th March 2020 2pm

COVID-19 – Initial Guidance for Businesses – https://www.marchesgrowthhub.co.uk/advice-and-support/coronavirus-information-for-businesses/

A message from Matt Potts, Business Growth and Inward Investment Manager at Shropshire Council.

Dear Oswestry BID Members,

I am writing to provide some initial guidance and information that is included in the attached letter from Shropshire Council Leader, Peter Nutting regarding COVID-19.

This situation is very much a moving one and further information will be provided in due course, including the process for applying for funding support and relief in further releases in the coming days.

We are in the process of setting up a business enquiry inbox specifically for COVID-19, which will be live in the next 24 hours, if you require any support please direct this to the following address; COVID19businessenquiries@shropshire.gov.uk. Please do also forward this information on to contacts in your network.

Kind regards

Matt

Matthew Potts BA (Hons), MSc, MIED

Business Growth and Inward Investment Manager